Why Invest in REITs? The Benefits of Real Estate Investment Trusts and the Success of Garuda Creekview

Real Estate Investment Trusts (REITs) offer investors a unique opportunity to participate in the real estate market without the hassle of managing individual properties. With their diverse portfolios of income-producing real estate assets, REITs provide several benefits for investors. In this blog post, we will explore the advantages of investing in REITs while showcasing the success of Garuda Creekview, a prime example of a thriving REIT investment.

Diversification for Risk Reduction:

Investing in REITs, such as Garuda Creekview, allows investors to gain exposure to a diversified portfolio of real estate assets. This diversification helps to mitigate risk by spreading investments across various property types and locations. With Creekview's mix of residential and commercial properties, investors can benefit from a well-rounded and balanced investment opportunity.

Income Potential and High Dividends:

One of the appealing aspects of REITs is their income potential. REITs are required to distribute a significant portion of their taxable income to shareholders in the form of dividends. This feature makes REITs an attractive investment option for those seeking a steady stream of income. Garuda Creekview has consistently delivered high rental income, making it an enticing choice for investors looking for reliable cash flow.

Liquidity and Easy Access to Investments:

Unlike traditional real estate investments, REITs offer liquidity and easy access to investments. REIT shares are traded on stock exchanges, allowing investors to buy and sell shares quickly and efficiently. This liquidity feature provides flexibility and convenience for investors, enabling them to adapt their investment portfolios as needed.

Regulatory Oversight and Investor Protection:

REITs, including Garuda Creekview, are regulated by authorities such as the Securities and Exchange Commission (SEC), ensuring transparency and investor protection. With rigorous financial reporting requirements and governance standards, investors can have confidence in the legitimacy and compliance of the REIT they choose to invest in.

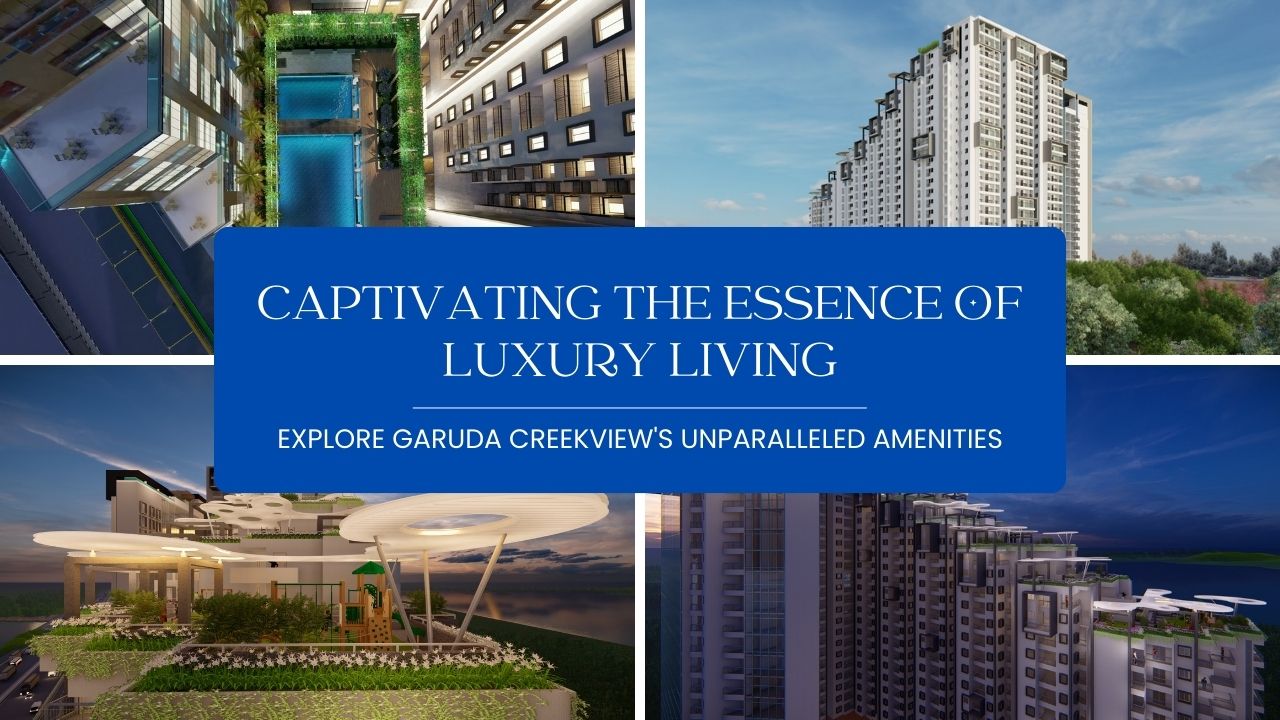

Garuda Creekview: A Showcase of REIT Success:

Garuda Creekview stands as a prime example of the success and appeal of investing in a REIT. With its diverse portfolio of residential and commercial properties in a prime location, Creekview has consistently generated high rental income for its investors. The project's commitment to excellence, adherence to regulatory standards, and focus on quality construction make it an attractive choice for those looking to invest in a thriving real estate venture.

Investing in Real Estate Investment Trusts (REITs), such as Garuda Creekview, offers numerous advantages for investors seeking diversified and liquid investments. The benefits of diversification, income potential, liquidity, and regulatory oversight make REITs an appealing option in the real estate market. With Garuda Creekview's track record of success, investors have the opportunity to participate in a thriving real estate investment that aligns with their financial goals.